A higher ratio indicates less reliance on debt and other external sources of financing, suggesting that the company has a strong financial position. Conversely, a lower ratio might suggest higher financial risk due to greater reliance on debt. The the direct write off method of accounting for uncollectible accounts, also known as the Equity Ratio, is a financial metric that measures the proportion of total assets funded by owners’ equity.

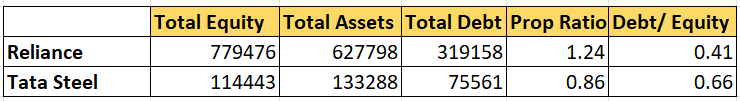

Comparing proprietary ratio with debt-to-equity ratio

Investors and creditors may also perceive such investments as higher risk, leading to difficulties securing funding or investors. Therefore, a low proprietary ratio may not always be a good sign for the company’s financial health. While the proprietary ratio can be a useful financial measure, it may not always accurately reflect a company’s capitalization.

- A high proprietary ratio signifies the company’s strong financial position, as a larger portion of its assets is financed by equity.

- Now, there are two methods by which, I could not only get this machine but also manage the leverage of the company.

- When the debt-to-equity ratio is high, it means that creditors have invested more in a business than the owners, and the creditors will suffer more in adverse times than the owners.

- Therefore, maintaining a balanced proprietary ratio is crucial for any business.

- In a nutshell, the proprietary ratio is a type of solvency ratio allowing investors and financial analysts to determine how much equity shareholders are contributing to the business.

Merchandising Business Examples (You Must Read This)

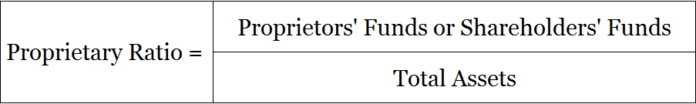

It also indicates that creditors will lose interest for providing finance to such a company. The proprietary ratio is calculated by dividing proprietors’ funds by total assets. It’s also important to note that some businesses, such as capital-intensive industries, may require substantial debt financing while maintaining high profitability.

Ask a Financial Professional Any Question

The proprietary ratio is a financial measure allowing you to assess the proportion of a company’s shareholder equity in relation to its total assets. Creditors often use the proprietary ratio to gauge a company’s financial health before extending credit. This ratio helps them understand how much of the company’s total assets are financed by shareholders’ equity. A higher ratio implies that the company is less dependent on external financing, which lowers the risk for creditors. On the other hand, a lower ratio may suggest financial instability and prompt creditors to either reject loan applications or charge higher interest rates. The proprietary ratio as a solvency ratio provides a sense of the percentage of assets shareholders would receive if the firm were to liquidate.

Ask Any Financial Question

Where proprietor’s funds refer to Equity share capital and Reserves, surpluses and Tot resources refer to total assets. A proprietary ratio measures the proportion of a company’s assets that its fund finance. In contrast, a debt-to-equity ratio measures the amount of debt financing relative to equity financing. The proprietary ratio establishes the relationship between the funds provided by the “proprietors” and the company’s total assets. The proprietary ratio establishes a relation between the ‘proprietors’ fund and the total assets of the company.

Out of current assets, inventories and prepaid expenses are not included because these cannot be converted into cash easily. To answer the question in the title, this article defines, explains, and provides examples of all the importance balance sheet ratios. Therefore, the proprietary ratio is a significant measure in finance for decision making and future investment planning.

Shareholders’ funds include equity, preference share capital, profits or losses, reserves, and surplus. Proprietary Ratio shows to what degree a company is financed by shareholders, while Debt Ratio shows the proportion of a company’s assets that are financed by creditors. It is a solvency ratio as you are essentially measuring the strength of a company’s capital structure.

This ratio methodically analyses the capital structure of the company, revealing the proportion funded by shareholders against the total resources of the company. The proprietary ratio and the debt-to-equity ratio are both crucial solvency ratios, but they measure different aspects of a company’s financial structure. While the proprietary ratio focuses on the proportion of a company’s assets financed by equity, the debt-to-equity ratio compares the total debt to shareholders’ equity. The proprietary ratio is calculated by dividing the shareholders’ equity by the company’s total assets, excluding goodwill and intangible assets. This calculation provides insight into how much of the company’s assets are financed by equity. A higher ratio suggests that long-term assets are more secure, reducing the risk for creditors in case of liquidation.

Proprietary ratio shows the proportion of total assets financed by proprietors’ funds. A high proprietary ratio indicates that a company uses more proprietors’ funds for purchasing total assets and maybe the company has room in its financial facility to assume more obligations. The proprietary ratio of 64% means, 64% of the total assets of the company are financed by proprietors’ funds. This means that 33% of the company’s total assets have been funded by the company proprietors.